Author: Geoff Cooper

Head of Investment Management, Chartered Wealth Manager - Chair of the Investment Committee

View profile

Published: June 2024

With all political party manifestos now public and under scrutiny from opposition and interested commentators, the usual infighting and cross-party disputes are in full swing. Angela Rayner faces challenges over Labour’s definition of “working people” following their manifesto pledge not to raise taxes for this group, while Rishi Sunak grapples with the PR fallout from the Conservatives’ betting scandal. Almost every poll indicates Labour is heading towards a majority greater than Tony Blair’s in 1997, making a Tory comeback seem increasingly unlikely.

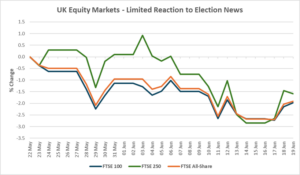

At MM Wealth, we’ve been monitoring market reactions to these developments with interest, if not surprise. It’s noteworthy that markets remain relatively calm, despite the constant political jibes and the incumbent leadership’s capacity for self-destruction.

Source: Morningstar, MM Wealth. Date for period 23/05/24 to 19/06/24.

The muted market reaction highlights how little attention is paid to political events, especially when the prospect of a Labour government appears to be a relief compared to recent European results, where there has been a significant shift towards populist hard-right movements.

For now, like the markets, we remain focused on the broader economic picture, particularly inflation and interest rates. Earlier this week, we heard that inflation has finally dropped back to the Bank of England’s 2% target, though this is unlikely to lead to an immediate cut in interest rates. Instead, markets were buoyed by yesterday’s announcement (20/06/24) that rates will remain at 5.25%, with Governor Andrew Bailey indicating a potential rate cut in August if inflation remains low. This is positive for markets but might be too late for Rishi Sunak, who would have preferred earlier interest rate cuts and a more favourable period for domestic markets.

So, while it’s an interesting time to follow political headlines, investors are unlikely to see groundbreaking market developments at this juncture. We continue to watch for substantive details on potential tax implications that will only become clear in a new parliament.

If you are worried about the value of your money in the bank coming into this next phase of the economic cycle, or would like us to review your current investments, please don’t hesitate to contact one of our Chartered Financial Planners.

Please contact us on 01223 233331 or email info@mmwealth.co.uk.

Contact us

Disclaimer

Opinions constitute our judgment as of this date and are subject to change without warning. The value of investments and the income from them can go down as well as up, and you may not recover the amount of your original investment.

The information in this article is not intended as an offer or solicitation to buy or sell securities or any other investment, nor does it constitute a personal recommendation.

The Financial Conduct Authority does not regulate estate planning and tax planning.

The information contained within this blog is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change.