Author: Geoff Cooper

Head of Investment Management, Chartered Wealth Manager - Chair of the Investment Committee

View profile

Published: July 2023

Following decades of unbridled industrial expansion, population growth and globalisation, the world is slowly waking up to the environmental and social challenges this has created. In response, investors are increasingly using their capital as a powerful tool for positive change.

Beyond financial returns, responsible investing considers the environmental, social, and governance (ESG) factors that shape our world. In recent years and particularly following the impact of Covid, it has gained considerable momentum and become increasingly important for the planet.

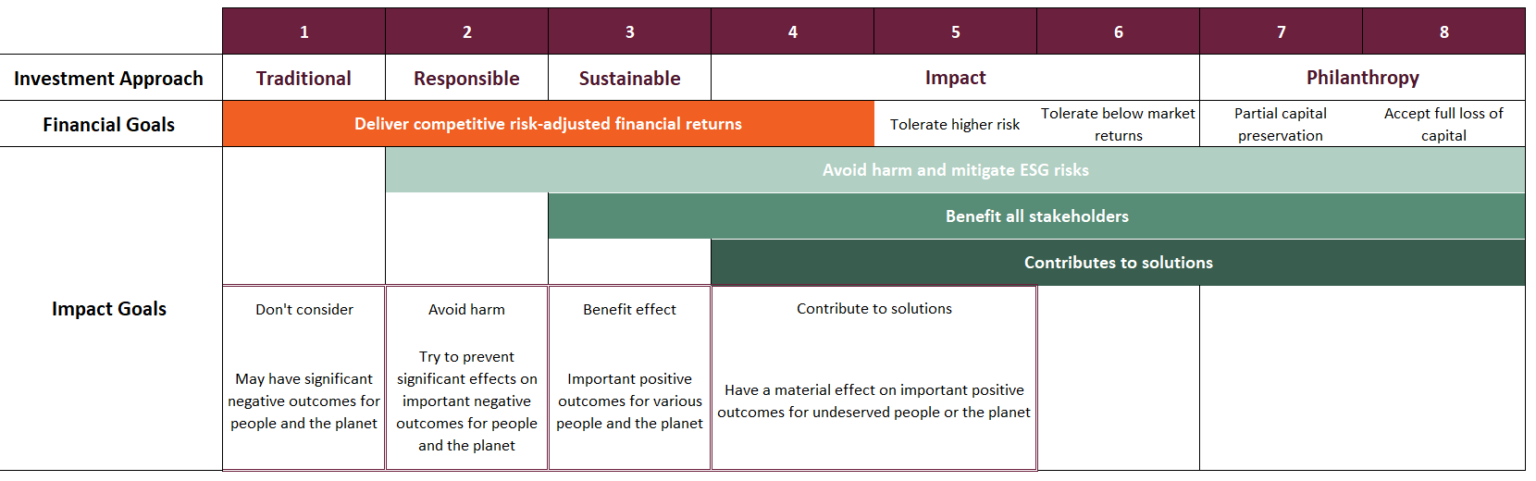

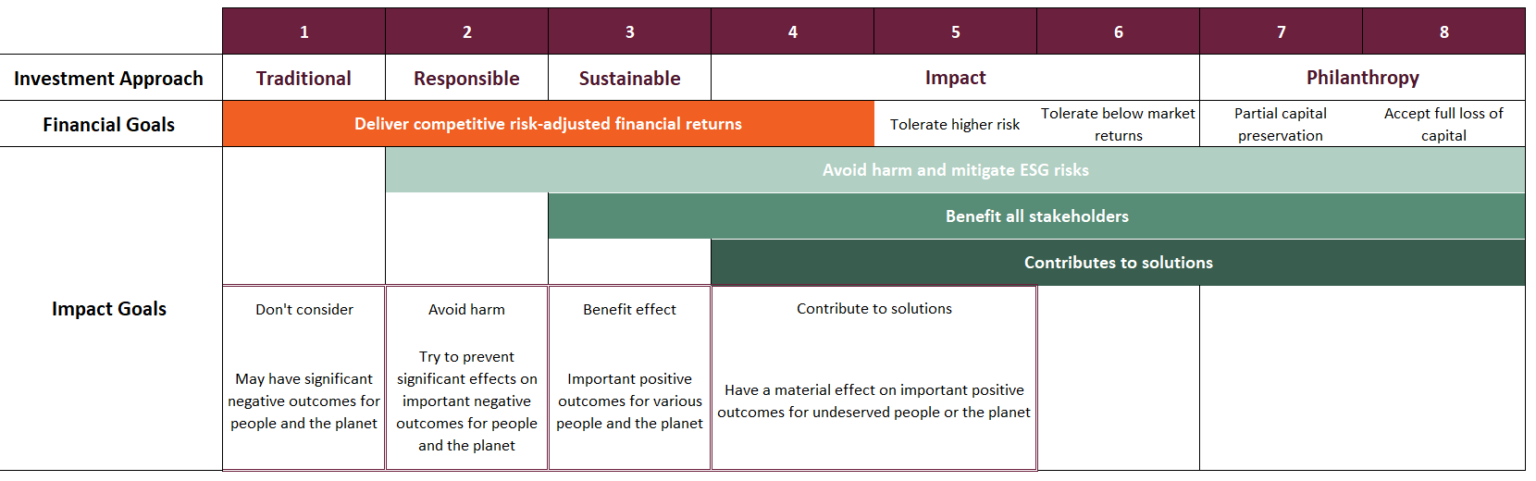

Navigating the complexities of responsible investing can be confusing and in 2017, The Impact Project identified the subtle differences from traditional, unconstrained investment approaches, creating The Spectrum of Capital below.

By incorporating ESG criteria, investors are able to align their capital with companies which are actively addressing issues such as climate change, deforestation and resource depletion. For example, they can support renewable energy, sustainable agriculture, clean technology, and conservation efforts.

The rise of responsible investing can also be attributed to a growing awareness of social issues and how companies interact with the community and environment. They play an important role in shaping a fair and equitable society, with consideration to human rights, labour standards, diversity and inclusion.

Responsible investing also emphasises strong corporate governance practices and transparency. Companies with robust governance structures and ethical awareness are less prone to scandals, corruption and unethical behaviour.

Through our investments, we can all contribute to a low-carbon future, encourage innovation in green technologies, and promote the transition to a more sustainable and resilient economy. We can encourage companies to uphold strong social values and foster better working conditions, promote equality, and contribute to sustainable development.

Here at MM Wealth, as the world faces these complex challenges, we believe that responsible investing provides an avenue to align financial goals with a sustainable and inclusive future for generations to come.

If you are looking for investment advice, please speak to a member of our financial planning team on 01223 233331 or email info@mmwealth.co.uk.

Disclaimer

Opinions constitute our judgment as of this date and are subject to change without warning. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment.

The information in this article is not intended as an offer or solicitation to buy or sell securities or any other investment, nor does it constitute a personal recommendation.

The information contained within this blog is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change.

The Financial Conduct Authority do not regulate tax planning.